Payroll services that can be tailored to the scale of your business

Organisations of all sizes can benefit from outsourcing their payroll to tilyanPristka as well as from our payroll solutions. From small start-ups to multinational corporations, our aim is always the same: To adapt our service to our clients needs.

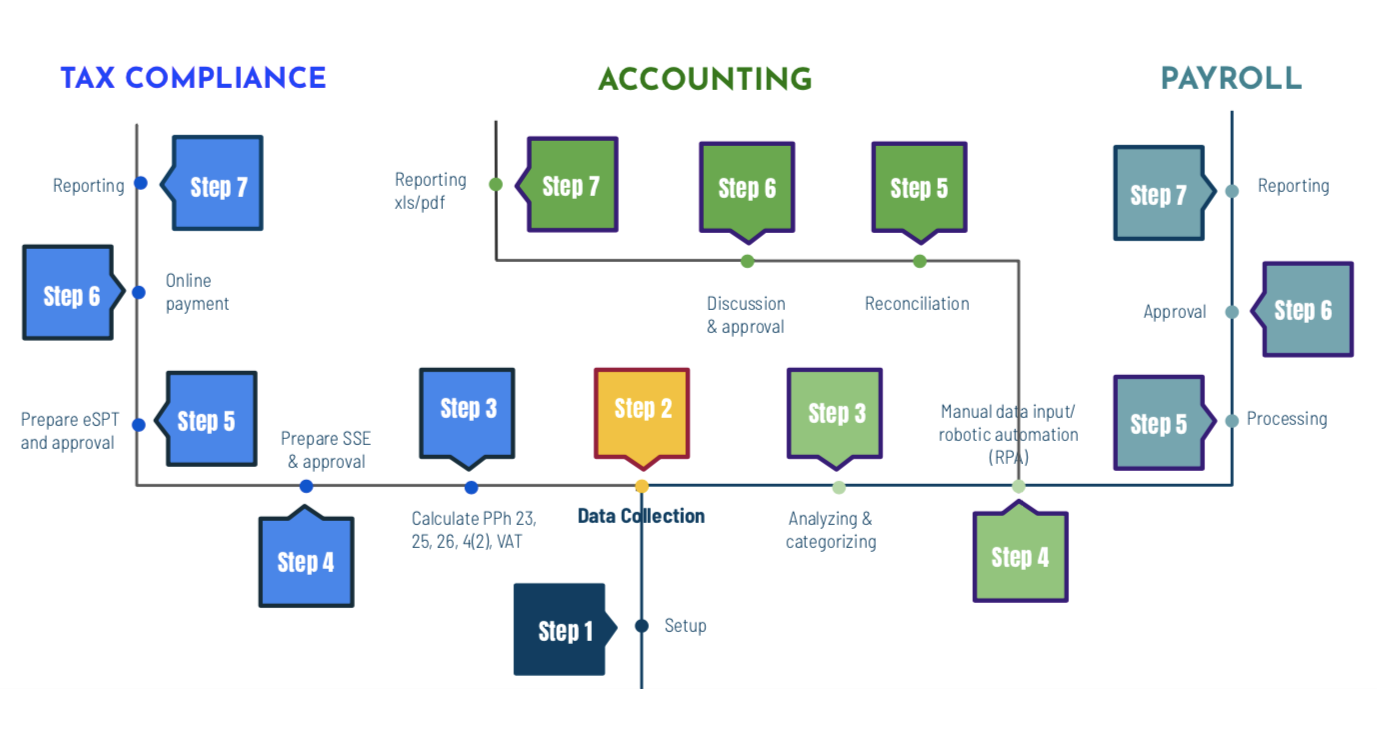

How we work - payroll outsourcing workflow

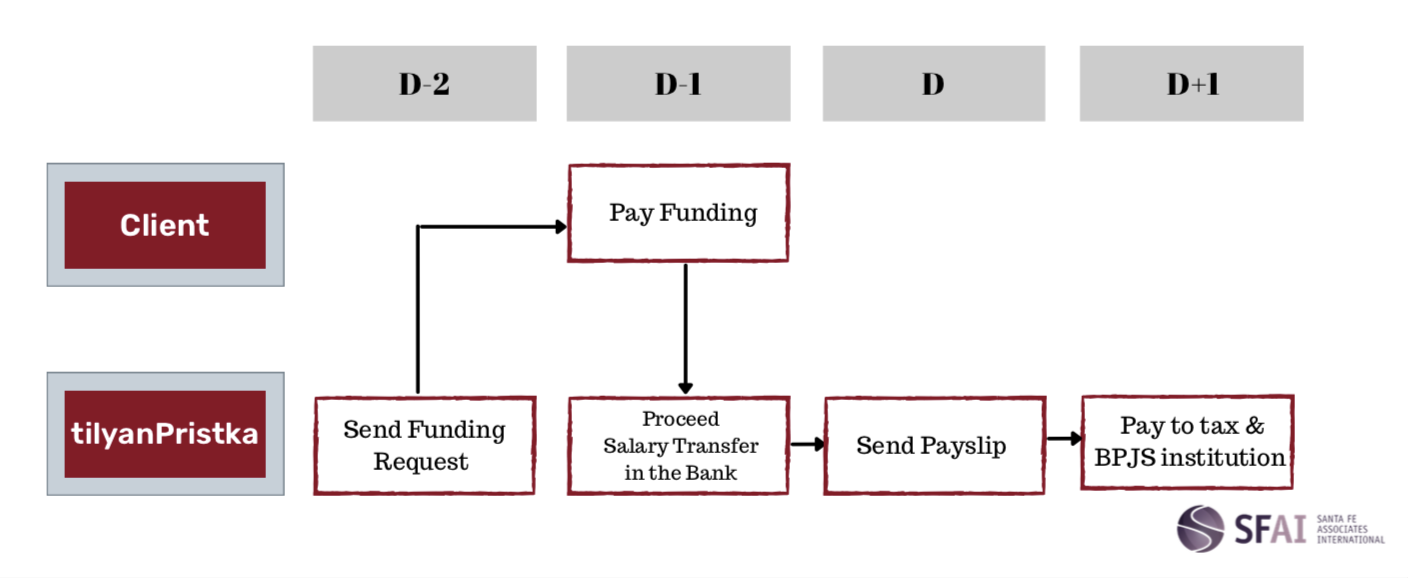

The primary purpose of cooperating with us is to ensure that all employees are paid accurately and timely with the correct withholdings and deductions and to ensure the remittance in a timely manner. This includes salary payments, income tax, deduction from a paycheck, and BPJS related (including as a liaison with BPJS Manpower & Health).

General workflow of payroll outsourcing in tilyanPristka

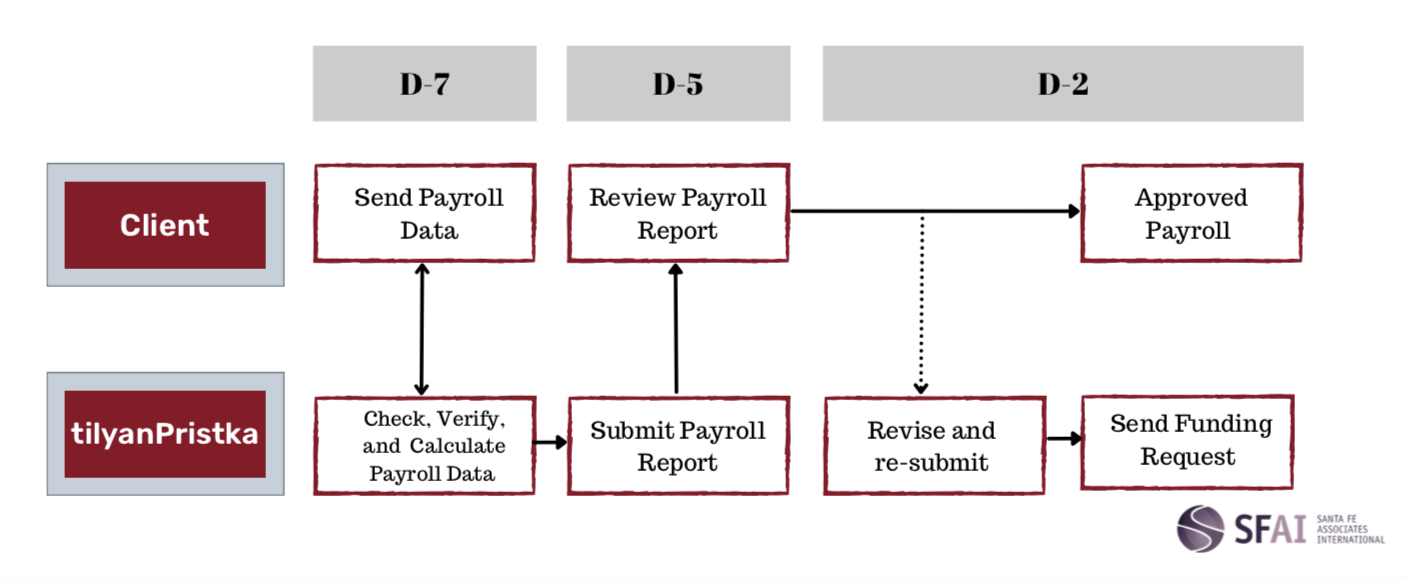

Detail workflow of payroll outsourcing in tilyanPristka

Payroll outsourcing service setup phase

-

Review and understand client's payroll system in order to set up proper calculation.

-

Set up procedures and timeline betweean client and tilyanPristka about payroll service.

-

Set up payroll master data to be inputted into our payroll software (collecting related all employees data).

-

Perform payroll calculation and tax reconciliation from the beginning of fiscal year up to current month.

A quality and transparent corporate payroll service that can be specifically tailored to meet your very company needs.

Payroll process outsourcing monthly activities

-

Perform calculation of salaries and allowances to be paid.

-

Perform calculation of tax article 21 (employee income tax) to be paid.

-

Perform calculation including report submission and payment of monthly Jamsostek.

-

Prepare and arrange payment and reporting of article 21 taxes and submit monthly returns.

-

Prepare salary slips.

-

Perform payroll reconciliation on monthly basis.

-

Other related reports required by management.

We work exclusively with permanent employees, who have completed an in-house internship covering various topics and processes, before they are made available to our clients as technically responsible contact persons.

Quality assurance and quality control for all of our reports are a central topic in our company and represent the basis of our customer satisfaction.